Abstract

Natural resource-led development is widely debated because of the difficulties of converting mineral wealth into greater social welfare. Thus, the construction of the Rio de Janeiro Petrochemical Complex - COMPERJ in the state of Rio de Janeiro, the largest Brazilian oil and gas producer, was undertaken as a strategy to overcome the effects of the "curse of natural resources" through productive diversification and urban improvements in part of Rio de Janeiro’s metropolitan periphery with historically deficient opportunities for social development and urban infrastructure. In this context, the article analyzes the trajectory of urban and regional development in the eastern portion of the Metropolitan Region of Rio de Janeiro between 2006 and 2016, highlighting the boom, burst, and doom of regional socio-economic dynamics. The study points out the main features and objectives of the project, the region's challenges at the time of the "mirage" breakdown of large industry-led growth, as well as its current conditions. The analysis of COMPERJ and its regional impacts reveals the risks and paradoxes of investing in this type of industrial megaproject as a platform to promote social development for a region lacking economic diversification and urban-regional planning.

Keywords: Industrialization; Natural resources; Urban and regional development; Job market; Megaprojects

Resumo

O desenvolvimento liderado por recursos naturais é amplamente debatido por conta das dificuldades de se converter a riqueza mineral em maior bem-estar social. Assim, a construção do Complexo Petroquímico do Rio de Janeiro - COMPERJ no estado do Rio de Janeiro, o maior produtor brasileiro de petróleo e gás, foi empreendida como uma estratégia de superação dos efeitos da “maldição dos recursos naturais” através da diversificação produtiva e melhoras urbanas em parte da periferia metropolitana do Rio de Janeiro reconhecida pelo déficit histórico de oportunidades de desenvolvimento social e infraestrutura urbana. Nesse contexto, o artigo analisa a trajetória do desenvolvimento urbano e regional na porção Leste da Região Metropolitana do Rio de Janeiro entre 2006 e 2016, destacando as fases boom, burst e doom da dinâmica socioeconômica regional. O estudo assinala as principais características e objetivos do projeto, os desafios da região no momento do rompimento da “miragem” do crescimento liderado pela grande indústria, bem como as suas atuais condições. A análise sobre o COMPERJ e seus impactos regionais revelam os riscos e paradoxos de se investir nesse tipo de megaprojeto industrial como plataforma de promoção do desenvolvimento social para uma região sem maior diversificação econômica e planejamento urbano-regional.

Palavras-chave: Industrialização; Recursos Naturais; Desenvolvimento Urbano e Regional Mercado de Trabalho; Megaprojetos

Introduction

Natural resources-led development is a subject of great attention in the field of urban and regional studies. The relationship between the initial allocation of a natural resource and the resulting levels of development has occupied the agendas of governments and research centers (BADIA-MIRÓ, PINILLA & WILLEBALD, 2015, BOIANOVSKY, 2013, SINOTT, NASH & DE LA TORRE, 2010; LEDERMAN & MALONE, 2007). Commonly, the driving force behind research efforts has been the search for explanatory reasons for low developmental indicators in some of the richest natural-resource regions of the world, notably the "non-renewable" resources. Since the beginning of the 1990s, the term "curse of natural resources" (AUTY, 1990) became a thematic watershed, being increasingly used to symbolize the negative effects derived from mineral production such as economic dependence, rentism, poor governance, and even violent conflicts. Although extensive, the international literature has focused on the "curse" experiences in the African continent and on a few "blessing" cases-cases of mainly Canada, Australia and Norway.

Although Latin America is a major natural resource producer, there is a lack of studies on the role that they have played in development, especially on urbanization and the productive structure of subnational scales. However, in the last few years regional studies have expanded (WILLIAMSON, 2015, REDSUR, 2014, ECLAC, 2013, PEREZ, 2010), largely due to the regional conjuncture during the commodity boom, a period of international price expansion between 2002 and 2014 (BACHA & FISHLOW, 2011). Despite this growth, a large part of the studies focused on the macroeconomic effects of the boom at a national scale (ALTOMONTE, 2013; BRUCKMANN, 2011), with few focused on the local dynamics (GORENSTEIN & ORTIZ, 2018; SILVA & MATOS, 2016). Recently, however, there has been an increase in research that characterizes the social, economic, and political contours of the "new extractivism" in Latin America (FARTHING AND NICOLE FABRICANT, 2018).

As one of the biggest beneficiaries of the boom, Brazil had in the binomial production & export of primary goods one of the pillars of its 2004-2014 growth model (CARNEIRO, 2012). Both on the agricultural-cattle and the mineral extraction sides, the country observed the expansion of investment in the production of wealth "that comes directly from the soil." With regards to oil, changes in the regulatory framework and the discovery of large reserves have transformed the domestic production scenario (POSTALIS, 2009).

The increase in the volume of investments in the oil sector caused the state of Rio de Janeiro to consolidate its position within the national scenario, becoming the stage for most oil & gas projects, among which the Petrochemical Complex of the State of Rio de Janeiro - COMPERJ is the largest individual investment in the history of Petrobras. Unlike other petrochemical megaprojects in the country, COMPERJ was not planned to be installed in an isolated area of the national territory. On the contrary, the choice of the Rio de Janeiro Metropolitan Region, the second largest in the country, was understood as part of a strategy to increase the Brazilian productive matrix, break economic stagnation, and propitiate social improvements as effects of the greater potential reach of the oil industry (MOYSÉS, 2010).

Within this context, the present article presents the trajectory of boom, burst, and doom of urban and regional development in the territory most directly reached by COMPERJ, Leste Fluminense. In addition, it contributes to the debate on the experiences of natural resource-led development in Latin America, notably showing the limits and challenges of industrialization pulled by megaprojects in peripheral regions, strategy sometimes defended as a way to overcome the supposed "curse" framework.

Through the analysis of the historical trajectory and economic and social indicators, the study shows how the developmental attempt in the COMPERJ case was quickly converted from mirage to regional discouragement. As a result, the study points to the weaknesses of "megaproject-oriented" regional development models, as well as the need for further reflection on the role of large industry as a vector of development in peripheral and economically depressed metropolitan areas. Finally, it makes clear the Janus faced condition of development led by COMPERJ: the absence of investments would have maintained regional stagnation, but the large exogenous resource package has not, until now, promoted the expected social advances.

Natural resources and development in Latin America

Because natural resources are the "beginning of everything," the basis on which world economic growth is sustained, they have great importance to the contemporary economy (DICKEN, 2012). It is worth remembering that the debate about the role of natural resources in economic development goes back to the so-called classical authors. If Adam Smith (1982, (1776)), for example, saw greater potential for generating wealth in manufacturing compared to agriculture and mining (through division of labor and expansion of internal markets), in Ricardo (1982 (1813)), although the focus was not on the "origin" of wealth but on its "distribution", we can note the centrality of natural resources in the discussion of land rents and the Grain Law within understandings about the general trend of the system's profit rates. In Malthus (1982, (1820)), concern about the trend of profit rates assumes more dramatic contours in its known prognoses about population growth and food production.

In Latin America, the role of natural resources and industry as engines of economic and urban growth has always been at the center of debates about development models and styles. Until the 1920s, these resources made up the productive base of the region and were responsible for the organization and occupation of its territory (OCAMPO, 2012). Furtado (1986) emphasized the existence of three basic structural characteristics of Latin American development, all based on the production of natural resources. In addition to the economies producing primary tropical goods, he distinguished those predominantly producing primary goods of temperate climate and those predominantly producing mineral goods. In all cases, he understood industrialization as a way to break the peripheral condition and reduce dependence on primary products.1

Once the national processes of post-1929 industrialization were initiated, the importance of primary production was not reduced, but rather restructured under guidelines other than simple export, with emphasis on the supply of goods for accelerated urbanization and for key industrial sectors, such as steel and oil. The cycles of Brazilian industrialization illustrate the role of primary production for national industrialization and urbanization (SERRA, 1982). Mining and the "country-side" were charged with the mission of generating foreign exchange mainly to meet both the urban-industrial demand (in order not to inflate sectorial production costs) and the reproduction of the labor force (wages), considered vital to maintain the overall profitability in the early stages of industrial growth.

Whether based on the ECLAC structuralists, or on the European development theorists, in the years following the Second World War, industrialization was accepted as the path to development for the capitalist periphery. It was assumed it generated technical progress and increasing productivity, changing the economies’ way of insertion in the international division of labor. At that time, the theoretical advances of the so-called "Development Economics" brought new concepts to consider territorial development, both at national and regional scales. From the theory of the "big push" (ROSEINSTEIN-RODAN, 1964), to "motor driven industry and the growth poles" (PERROUX, 1955) and the back and forth effects (Hirschman, 1958), economic theory progressed towards a better understanding of development processes with strong territorial content. Both the effects of agglomeration and propulsion brought about by the industry and the resulting urbanization were constant in the contributions of these authors.

ECLAC highlighted regional diagnoses and the defense of planning as an instrument to overcome the "center-periphery" condition (BIELSCHOWSKY, 2000). In general, Latin American structuralists understood industrialization as a sine qua non condition for breaking the peripheral relations that kept the countries of the region far from the patterns of accumulation in the "center". Urbanization and industrialization would allow for increased productivity through the incorporation of technical progress, creating more favorable conditions for breaking the structural moorings of the primary export model. The diffusion of technical progress with the expansion of internal consumption not only would allow the inward shift of the dynamic center, but also the reversal of position in face of the deterioration of terms of trade in the international market.

The debt crisis and the inflation of the 1980s displaced the development agenda to second place in most Latin American countries. It gradually resumed only after the second half of the 1990s. Because of their type of insertion into the global economy, most of these countries saw commodities play a central role in growth strategies again; in general, no longer as support for industrialization, but rather as export-based growth valves with strong effects on productive structures and territories.

In general, criticisms of Latin American primary re-specialization have come from Keynesian- and/or Neoschumpeterian-inspired authors who emphasize the effects of currency appreciation or the absence of appropriate industrial policy to reverse the effects of the "Dutch disease" in the region (CARNEIRO, 2012, OCAMPO, 2012, SILVA, 2013). On the other hand, there is also the Marxist criticism about the meaning of the so-called "neo-extractivism" (LANDER, 2014; BRUCKMANN, 2011) and the "commodity consensus" (SVAMPA, 2013) for the territories of the region in the face of the consolidation of China as a new global economic power (PINTO, 2013).

Thus, it can be observed that the contemporary debate is concentrated in three axes: the defenders of the deepening of productive specialization in basic products, considered the regional comparative advantage; the proponents of policies to stimulate the production of primary goods combined with a strategy of reindustrialization or productive sophistication; and finally, those who understand the process from a perspective of global power, imperialism, and acute dependence, which cannot be completely overcome within the frameworks of capitalism.

Oil-induced development in Brazil

Among the developing countries, Brazil stands out as having a diversified productive structure including some of the main branches of the contemporary world industry (SKIDMORE et al., 2014). This is the result of the industrialization by import substitution that took place between 1930 and 1980 (CANO, 1998; BAER, 2012), which created rapid and unplanned urbanization and a strong population concentration in the peripheries of the national metropolises, especially São Paulo and Rio de Janeiro (FARIA, 1993).

One of the flagships of the Brazilian economy, the oil industry has directly participated in the national development cycles. Currently, it accounts for 12.4% of the Gross Domestic Product of the country, with recognized importance on the growth of industry and public finances of the federal and subnational governments (SILVA, 2012). With the tenth world-largest proven oil reserve, Brazil has a relative importance in the global oil geopolitics, especially due to its own high-sea oil and gas extraction technology developed by the great national company, Petrobras. This development was need-based, since most of the national reserves are located on the maritime platform, at high depths, especially in the Campos and Santos Basins, located in the southeastern portion of the national territory.

With the new Oil Law in 1997, the country began to undergo major transformations, especially in relation to federative entities (POSTALIS, 2009). Despite these changes, at the turn of the century domestic production was limited to 2 million barrels per day, an amount that neither stimulated greater investments nor met national consumption. The discovery of new deposits and changes in the international price of oil in the first decade of this century changed this scenario. In 2007, former President Lula announced the discovery of large oil and gas reserves in the pre-salt layer of the Brazilian coast, a region of approximately 140,000 Km2 between the states of Espírito Santo and Santa Catarina.

The "pre-salt" oil was accompanied by rapid expansion estimates: the country would rapidly double its production, reaching 5.4 million barrels per day by 2020 (SILVA, 2012; SILVA & MATOS, 2016). Expectations increased the investments of the oil sector aiming for the greater exploitation of its potential. For example, in its 2008 Business Plan, Petrobras indicated investment plans in the order of US $ 240 billion (up to 2017), of which more than 60% would directly go to pre-salt exploration and production (FIRJAN, 2009). Three years later, the company would broaden this target to $ 500 billion (up to 2022), including bold targets for expanding the sector's infrastructure, especially in refining and transportation. The pre-salt potential also came to be seen as a unique possibility for social development. There is the understanding that the resources coming from pre-salt production would be an opportunity for the establishment of country goals and commitments in relation to socio-economic development and the overcoming of historical debts, among them the deficits of urban infrastructure.

The state of Rio de Janeiro stands out as the central space for investments in the sector. Since 70% of Brazilian oil and 55% of natural gas are extracted on its coast, the main investments in the oil and parapetroliferous industry are located in its territory, especially those dedicated to the extraction, transport, and construction and maintenance of the fleet (ships and platforms). The new cycle that was envisioned brought, as a novelty to Rio de Janeiro, plans of investment in sectors at the tip of the petroleum chain, called the downstream, besides the already traditional ones in logistics, shipbuilding, and technical qualification of labor (FIRJAN, 2009). In the downstream, the state would internalize one of its old demands, a new and modern refining and processing plant. Thus, the decision was taken to build the Petrochemical Complex of the State of Rio de Janeiro, considered the most important investment in the entire national industry in the period.

COMPERJ is the largest megaproject executed in Brazil in the last three decades and the largest single investment in Petrobras' history. In addition to its physical and financial magnitude, the complex was notable for its goals related to urban and regional development (RIMA, 2006) and greater national sovereignty. In relation to the former, it was expected that its installation would act as a big push for the development of one of the poorest regions of the metropolitan periphery of Rio de Janeiro, bringing not only productive clustering, but also especially social improvements. With regard to the second, COMPERJ would help the country reduce its dependence on imported derivatives, since it was designed to meet the refining needs of pre-salt oil (PETROBRAS, 2008).

Being offshore has been pointed out as a challenge to the oil industry in Rio de Janeiro, given the difficulties of "bringing to earth" the productive dynamics realized 400km away from the coast (PIQUET, 2011; ARAÚJO, 2001). Although this type of industry has greater potential for linkages in the entire industrial complex, the fact of being located "off land" is a challenge to the social, productive, and urban development of the producing region. In Rio de Janeiro, the low downstream weight has led to less use of the oil industry's potential to generate employment and wealth throughout the state (SILVA, 2017).

In addition to the pre-salt potential, the favorable international price environment contributed to the optimistic scenario, culminating in an expansion of investments. Between 2002 and 2013, the world commodity market was favorable to the producing countries, in what was called a commodity boom or super-cycle (SILVA, 2013). Similar to other Latin American countries, Brazil experienced a favorable conjuncture in the so-called terms of trade, resulting in a greater inflow of foreign exchange (ALTOMONTE et al., 2013, REDSUR, 2014). Changes also occurred in the territorial economic dynamics of the producing regions and/or linked to their circuits (CARNEIRO, 2012, ECLAC, 2013). In addition to the improvement of regional trade balances, there was a clear process of reorientation of productive forces in favor of production/export of basic products, leading to national reprimarization, significant changes in the social production of space (SILVA, 2013, BRANDÃO, 2016), and concerns about the paths of national urbanization, especially in relation to the risk of recoastal urbanization (DINIZ, 2012).

COMPERJ: Origins and the promise of development

Rio de Janeiro is one of the main sub-national spaces impacted by the production of commodities. Economic and urban-state dynamics were closely linked to the "oil economy", understood not only as the production of oil and natural gas but also of all chain sectors, such as warehousing, transportation, refining, and shipbuilding (Piquet, 2011; Silva, 2012; Jesus, 2016; Torres, CAVALIERI & HASENCLEVER, 2013). As a unique greenfield investment, COMPERJ was the major project of the period, both in terms of physical size and the financial and human resources mobilized.

Located in Itaboraí, in the eastern part of the Metropolitan Region of Rio de Janeiro (RMRJ), the complex occupies an area of 45,000 Km2, which corresponds to approximately 10% of the municipal territory (Figure 1). The choice of Itaboraí as the complex's headquarters was due to its geographic positioning and the large supply of available land (MOYSÉS, 2010; STUDIO CLASS AND IRAZÁBAL, 2011). Although it accounts for 6.4% of the state's territory, the municipality is home to 1.0% of its population, with a population density of 506.5 inhabitants / Km2, well below that of RMRJ (2,221.8 inhabitants / Km2). Its population, mostly urban (98%), is concentrated in a few districts near the municipal core (IBGE, 2017). The region considered affected by the enterprise is broader, comprising 11 municipalities, which correspond to 14.5% of the population and 11% of the state territory. This region is marked by large differences in the distribution of income and public services, with large numbers (34%) of people living in slums.

Since 2002, this region has been recognized by the inter-municipal institutional arrangement known as Conleste, initially designed to articulate and coordinate policies and actions on the use of water resources. With the arrival of the large enterprise, Conleste's scope of action was expanded and redirected to propose actions that would mitigate the impacts of the complex's installation and expand regional development potentials (STUDIO CLASS and IRAZÁBAL, 2011).

The complex began to be deployed in 2008. It was designed to be a large joint industrial complex that would increase the national supply of 1st and 2nd generation oil products (propene, benzene, styene, polypropyl, and others). Petrobras would lead the venture, projecting investments of US $ 10 billion. In addition, it was estimated that two hundred private companies would work on the various fronts of the complex and that together they would invest another US $ 200 million. In full operation, it was expected that the whole complex generated revenues of US $ 6 billion, with US $ 2 billion of real gain for Petrobras. For the whole state, 212,000 new jobs were estimated (direct and indirect), and between 15,000 (pessimistic prediction) and 31,000 direct jobs (optimistic prediction) would be in the complex (FIRJAN, 2009, p. 4-6; BRITTO, 2011, p. 13).

Amid the national economic expansion, the initial plans were changed. Instead of a single refinery articulating all production, Petrobras decided in 2009 to build a second refining unit, increasing its production capacity from 150,000 to 330,000 barrels per day. With these changes, the start-up forecast changed from 2013 to 2017. In the meantime, the production of petrochemicals that would use components and "leftovers" of the first refinery's production process would begin (BRITTO, 2011, p.12). For public finances, an immediate increase was expected in the public coffers of the state of Rio de Janeiro and the eleven municipalities directly affected, via an increase in the tax base. A large increase was also expected in the local economy as a whole, especially in sectors more sensitive to structural changes, such as construction, commerce, lodging, and the real estate market (BRITTO, 2011).

Industrialization is still seen as the main path to development by a large part of Latin American thought. COMPERJ must be understood within this field of the political economy of development. At the territorial level, the so-called "petroleum economy" in Rio de Janeiro has been marked by the petro-rentist profile, which has been identified as one of the main problems of the economic structure of Rio de Janeiro, and its overcoming as a regional challenge (SILVA, 2017). While one of the main actions planned by the Growth Acceleration Program (PAC) of the Lula and Dilma governments, the complex responded to a perspective of growth driven by demand; in this sense, it was expected to act as a big push (ROSENSTEIN-RODAN, 1961) for regional development, helping to overcome the "curse." At the national level, COMPERJ would allow the country to reduce its external dependence on oil products and to expand technical progress.

Migration and growth in Leste Fluminense

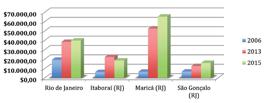

Recent demographic and economic dynamics indicate the regional impacts of COMPERJ. Initially, it should be noted that, between 2000 and 2015, when the complex was not yet operating, the population of COMPERJ’s region expanded by 19%, while that of the state of Rio de Janeiro grew by 15%. The region's nearly 400,000 additional inhabitants are due to the growth observed in the central municipalities of the project, especially Itaboraí, São Gonçalo and Maricá, noting that the former two stand out in terms of total variation, while Maricá by percentage growth (Table 1).

In relation to the economy, the region showed growth well above the state average, reaching 57% for the period 2009 to 2015 (the first year after the beginning of the implantation works of the complex and last year that there are data available for so far, respectively). Among the municipalities in the region, only four did not grow above the state average, while the others presented very good performance, particularly Itaboraí and Maricá (Table 2). Maricá had the highest rate (604%) as a result of the expansive trajectory of sectors supporting the activities of COMPERJ, including the real estate sector and services oriented to the higher income classes. Itaboraí, in turn, grew 45%, and its gross domestic product per capita rose from R $ 11 thousand (in 2010) to R $ 22.2 thousand (in 2015), despite its strong population growth.

Burst and Doom: Economic explosion and regional crisis

After more than a decade of relative economic boom, in 2014 Brazil began to experience a deep contractionary cycle, marked by abrupt reduction of economic growth and fiscal misalliances. The strength and scale of this crisis were relatively unexpected, especially in light of the previous ten years of great economic performance combined with the improvement of the living conditions of the poorest social strata. In addition, Petrobras became the target of the largest anti-corruption operation in the country's history. The "Lava-Jato" operation has been working to combat a corruption scheme involving the company and its operations, including the construction of COMPERJ.

In addition to the international decline of commodity prices, Lava-Jato actions have rapidly changed the country's oil industry scenario. Being the main investment center of Petrobras, Rio de Janeiro had its economic dynamics directly affected both in the spheres of production and finance. On the one hand, the elimination and/or interruption of projects demobilized the investment contributions of Petrobras to the state territory; on the other hand, the fall in oil production and prices toppled the amount received in the form of royalties, leading the state and several municipalities to become insolvent (SILVA, 2017).

The greatest example of urban and economic imbalance was Itaboraí. The one who was, in the words of former president Lula, "the greatest investment made in Brazilian territory in recent times" and on which hopes of greater growth and transformations for the metropolitan periphery were placed, saw the almost complete paralysis of its works. In a short time, therefore, the image of “works cemetery” replaced the image of the new national “El Dorado”. Figure 2 summarizes the stages of the development of COMPERJ, pointing out the main characteristics of each phase. From the strong economic dynamism observed in the boom to the sudden paralysis in the burst, a scenario of doom followed, in which discouragement in relation to the regional future prevails.

From a dormitory city, Itaboraí became one of the municipalities that received the most migrants in the period 2008-2013. During the period of installation of the works, in the boom, around 35 thousand workers (many with their families) moved to the region in search of new opportunities for jobs, businesses, and better living conditions (IBGE, 2017), almost all of which was absorbed by the labor market stimulated by works of and support services to the complex. However, of the total number of workers employed in the boom, there was less than one-third in 2017, a very small amount considering the size of the enterprise and especially the initial expectations.

One of the immediate effects of this influx of migrants was the pressure on public services.2 If, in the midst of the "bonanza", public spending was expanded, when there was a standstill, local finances did not have the necessary flexibility. Contracted expenses were rigid, as opposed to declining revenues. Among the sectors that grew with the venture, the situation was not different.

The real estate market, commerce, and small services had expanded amidst the structural changes. But today, Itaboraí presents a scenario called by some as "ghost town", given the amount of real estate and vacant residences with "rent-out" or "sell-out" signage. Buildings for shopping centers and business and residential condominiums were quickly built to meet the growing demand for specialized services, and quickly became "white elephants" in the landscape of the region.3

As pointed out in an article published in Época Magazine:

Major real estate projects - such as the ambitious Van Gogh Corporate and Hellix Business Center towers - that have been erected to respond to the eventual demand for sophisticated services are today white elephants with first-rate finishing and terraced pools yet to debut. Small entrepreneurs who set up lodges have closed the deal and desperately sell the beds and the rest of the furniture to recover a part of the failed investments.

Janus faced development in Leste Fluminense: Bad with COMPERJ, worse without it

What, to date, represents the urban-regional development strategy of the East of Brazil led by the industrialization based on natural resources? First, it is worth noting, in the state of Rio de Janeiro, the historical relationship between the metropolis and its immediate periphery. It became unique within the national context (DAVIDOVICH, 2000), since the city of Rio enjoyed the special condition of capital of the country until 1960 and of a state of the federation until 1975, when it merged with the territory of the old state of Rio de Janeiro, thus forming the state as known today. Years as the capital of the country and later of a state of the federation allowed the city of Rio de Janeiro to urbanize and develop under the signs of capital, while its periphery articulated to its economic dynamics in a complementary way, often as a bidder of labor, land, or other resource that did not exist or had a high opportunity cost in the territory of Rio de Janeiro.

In this context, the periphery of Leste Fluminense became a region marked by the lack of economic and social infrastructure that could meet the growing population resulting from the intense rural-urban migratory process in the country at that time. The region faced major obstacles in terms of connection to the dynamics of the metropolis. The absence of effective means of communication, for example, made exchanges with the city of Rio de Janeiro expensive. Therefore, to a large extent, the region became more dependent and connected to the municipality of Niterói. This only began to change with the construction of the Rio-Niterói Bridge (1974), which shortened the distance between the eastern periphery and the economic regional center and the western periphery, the Baixada Fluminense. In the East, just as in the West, a precarious urban fabric was formed under a productive base that had as its historical conditioners declining rural services and activities.

Despite being an economic area with a certain productive base, the metropolitan periphery of Rio de Janeiro still lacks substantive investments in the manufacturing and infrastructure sectors, understood as windows of opportunities for the region in terms of social development. The first decades of the twenty-first century showed that, while the city of Rio de Janeiro experienced the effects of the investments that were made due to international mega-events, its periphery was not considered and more directly connected to the possible gains of the dynamism of the "Olympic City". The planning of those events did not, in fact, consider the metropolitan periphery as part of the process, save as a supplier of labor, especially that of low specialization.

Analyzing the regional dynamics of the Brazilian economy, Brandão (2016) argues that, in the first decades of the present century, a set of five different types of territories formed the basis of the national regional development pattern. The five types of territories highlighted by the author consider the determinants of the regional accumulation cycles. Curiously, the COMPERJ brought to its territory structural characteristics of two different types of detached territories. Firstly, the “COMPERJ region” would be delimited to “territories predominantly impacted and (re)defined by investments made or directed by the State in transport and energy infrastructure.” These include the role of investment multiplier effects “as a product and generator of externalities and synergies with a high degree of generalization of use for the development process". In addition, it also shows traces of a territory “predominantly impacted and (re)defined by the inertial force of agglomeration and urbanization factors and productive locational advantages in the urban South-Southeast network,” due to “the inherent gains in productive agglomeration and their role in terms of inertial and centripetal forces” (BRANDÃO, 2016, p. 20).

Considering conditions until now, the region has also shown to be a territory "predominantly impacted and (re)defined by the implementation of one-off investments, with the tendency to become isolated poles or enclaves with low induction of the surroundings and the hinterland. Its main characteristic is to be “highly intensive territorial and environmental platforms, which produce semi-manufactured products (...) such as oil and gas exploration and extraction, refining and hydro, wind and solar electricity.” In this case, new national development fronts would be dominated by large investment projects that are expected to push polarized growth "decisive in the Brazilian industrial matrix, representing a large part of our productive and commercial export specializations and our greatest comparative competitive advantages revealed" ( BRANDÃO, 2016, pp. 21-23).

For Matias and Silva (2017), the metropolitan periphery of Rio de Janeiro achieved some dynamism from the booming economic period experienced by the country, not due to the productive forces that propelled the metropolis, but to the development model of the country. The area dynamism was more due to the growth of the national and international market and to becoming a receptacle of projects of economic and logistic infrastructure of great physical and financial dimensions.

Thus, some of the poorest municipalities of the RMRJ became inserted in the national developmental period. Both to the East and to the West, a trend of conquering the edges developed. In the western part, the municipalities Seropédica, Japeri, Queimados and Itaguaí are the main examples of the effects of territorial incorporation and social reproduction of space within a national expansive logic. In the East, Itaboraí is certainly the main focus, followed by Maricá. While in the West the dynamics were driven by investments in the steel and logistics industries, in the East the expansionary logic had its base in the oil industry, both as a demander of specialized services and products, as well as inductor of new investment fronts that sought to expand the frontier of national production in derivatives, as in the case of COMPERJ.

It is worth mentioning that the RMRJ is also part of a global pattern of natural resource-led growth. Arboleda (2013), based on Lefebvre’s (1970) contributions on the "explosion of spaces" and the contradictory and dialectical process of territorial "homogenization and fragmentation", points out that the increasing demand for primary resources led to the explosion of spaces in all the parts of the globe, notably territories of the Global South. In this context, Latin America has become a privileged space for the explosion of spaces derived from extractive activities, especially of infrastructure sectors planned for the support or transformation of the main product.

Klink (2013) understands the investment projects received by RMRJ in the post-2000 period as the fruits of a crop of rolled-out development, in reference to the fact that their relations and objectives are close to those that marked the so-called rolled-out stage of neoliberalism on a global scale (PECK & TICKELL, 2002), notably the search for increased competitiveness and the rescaling of global semi-peripheral spaces. He realizes that the region was undergoing a certain economic recovery after decades of strong decadence; however, this process was based on a series of projects of great measure and impacts on the territory that sought to make Brazil a country of greater competitiveness in strategic sectors in the international arena.

For all this, we affirm that, in terms of development, the scenario of the metropolitan East of Rio de Janeiro presents itself as a Janus faced experience, given that the modernization sought by the large industry became territorialized in the midst of typical features of Latin American underdevelopment, sometimes reinforced amid the promise of overcoming historical dilemmas and liabilities. Thus, parallel to the modernizing dream, a series of new and old problems presented themselves daily, including increased crime, informality, and environmental damages.

As already pointed out, both Itaboraí and Maricá, municipalities historically recognized as "dormitories", presented economic growth above the state average, attracting workers and creating new fronts of small- and medium-sized businesses in the tertiary sector. These changes contributed to the improvement of the Regional Human Development Index (HDI), which progressed between 2000 and 2010 in all municipalities in the region affected by COMPERJ (Graph 1). However, the deconstruction of the components that make up the HDI (education, longevity, and income) shows that the improvements shown were more due to indicators of basic education and longevity and less to income. Those indicators showed improvement in almost all the regions of the country as a result of public policies of national scope focused on schooling and basic health of the population. Thus, income, the indicator that would express a greater dynamism of the endogenous forces in the territory of COMPERJ, although improved, was not the main determinant for the global gain.

It is worth mentioning that the RMRJ is also part of a globally observed pattern of natural resource-led growth. Arboleda (2013), based on the contributions of Lefebvre (1970) on the "explosion of spaces" and the contradictory and dialectical process of territorial "homogenization and fragmentation", points out that the increasing demand for primary resources led to the explosion of spaces for all the parts of the globe, notably territories of the Global South. In this context, Latin America has become a privileged space for the explosion of spaces derived from the extractive activity, especially of infrastructure sectors planned for the support or transformation of the main product.

Klink (2013) understands the investment projects received by RMRJ in the post-2000 period as the fruits of a crop of rolled-out development in reference to the fact that their relations and objectives are close to those that marked the so-called rolled-out stage of neoliberalism on a global scale PECK & TICKELL, 2002), notably the search for increased competitiveness and the rescheduling of global semiperipheral spaces. It understands that the region was undergoing a certain economic recovery after decades of strong decadence, however, this process was based on a series of projects of great measure and impacts on the territory that sought to make Brazil a country of greater competitiveness in the international scenario in sectors strategies.

For all this, it is possible to affirm that, in terms of development, the scenario of the metropolitan East of Rio de Janeiro presents itself as an experience with the face of Janus, given that the modernization sought by the large industry consubstantiation territorially in the midst of typical features of the Latin American underdevelopment that are sometimes reinforced amid the promise of overcoming historical dilemmas and liabilities. Thus, parallel to the modernizing dream, a series of new and old problems presented themselves daily, including increased crime and informality and environmental damage.

As already pointed out, both Itaboraí and Maricá, municipalities historically recognized as "dormitories", presented economic growth above the state average, attracting workers and creating new fronts of small and medium businesses in the tertiary sector. These changes contributed to the improvement of the Regional Human Development Index (HDI), which improved between 2000 and 2010 in all municipalities in the region affected by COMPERJ (Graph 1). However, the decomposition of the components that make up the HDI (education, longevity and income) shows that the improvement presented more was due to indicators of basic education and longevity and less income. These indicators showed improvement in almost all the regions of the country as a result of public policies of national scope focused on schooling and basic health of the population. Thus, the indicator that would express a greater dynamism of the endogenous forces to the territory of the complex, the income, although it has improved, was not the main determinant for the global gain.

The analysis of recent years brings further concern. Between 2013 and 2015, while its population did not decrease, Itaboraí lost share in the GDP of the state of Rio de Janeiro, falling to 0.64% after approaching 1.0%. This was due to the fall in GDP between the two years, which represent respectively the last period of the regional boom and the most recent period of the doom for which information is available.

Due to this contraction, the per capita GDP of the municipality also suffered a sharp decline (Graph 2). Between 2013 (last year of the boom) and 2015 (already in the midst of doom), the per capita income of Itaboraí suffered a considerable retreat, indicating the impacts related to the stoppages of the implementation works of the complex. On the other hand, the same indicators did not show a reduction in Maricá, perhaps due to the greater diversification of its economy compared to that of COMPERJ’s municipal base. With no large variations in the denominator, the dynamics of per capita incomes show that the sectors located in these two municipalities started to respond to the dynamics of other sectors.

From the social point of view, the dynamics of the labor market is the most important variable to measure the strength of the transformations coming from large projects. Data from the Annual Social Information Report of the Ministry of Labor and Employment (RAIS, 2017) show that the period 2008-2013 was the boom period of regional growth led by the arrival of COMPERJ, with 2014 marked by the burst, followed by doom.

For Itaboraí, the data indicate that between 2008 and 2013 the local labor market jumped from 22 thousand to about 50 thousand formal jobs, a figure that suffered a sharp decline since 2014, reaching almost 28 thousand in 2016. Of the sectors directly associated with the complex, the manufacturing industry stands out jumping from 4 thousand workers to its top in 2013 with almost 6 thousand jobs. The sector ends the period with 3,800 workers in 2016.

However, in the construction phase of the complex, the larger sector is construction, responsible for all the buildings, urbanization, and earthwork of the project. In 2008, this sector employed around 3,500 workers, reaching a total of 16,500 in 2013. In 2014, there was a considerable decrease in the amount, although it remained at a high level. By 2015, the crisis had hit hard, and the sector started to employ less than 2,500 workers. The other major employers are the service and commerce sectors, which followed the same path of construction, with strong expansion of jobs and a sharp decline, although they presented smaller declines and currently partially became the "buffer cushion" of the local labor market.

Many of the unemployed workers have their origins in other parts of the territory of Rio de Janeiro and even in Brazil, attracted by the opportunities announced at the launch of the project. It is estimated that some 17,000 unemployed people still remain in the municipality waiting for the return of activities or, in many cases, payments of months of wages and arrears by small and medium-sized firms that were Petrobras’ suppliers, which suffered bankruptcy or delinquency due to the blocking of payments determined by the courts (O Globo, 2016).

Even the most recent information on the partial resumption of works in 2018 does not bring hope of reaching the levels of employment and income expected during the boom. According to information published by the newspaper O Globo on February 6, 2018, part of the project could be resumed with investments from Petrobras and a group of Chinese investors, which would lead to significant changes in the project's initial objectives and projections. The same periodical, on May 15, 2018, highlighted that the observed improvement in international oil prices has led Petrobras to increase its oil production in the Santos Basin pre-salt layer, which covers part of the south of Rio de Janeiro and along the coast north of São Paulo. Since the oil in the Brazilian pre-salt layer is of the associated type (mixed with natural gas), the more feasible economical and environmentally option is the processing of this oil in order to separate the natural gas from its composition. This makes resuming the construction of the natural gas processing unit (UPGN) urgent and strategic, already planned in the initial project of the complex. Scheduled to start operations in 2020, UPGN would double Petrobras' gas processing capacity to more than 40 million cubic meters per day, as well as stimulate the growth of several sectors of the transformation industry dedicated to the construction of machines and equipment specific to the sector. Its investment would be partly backed by Chinese capital (almost $ 2 billion from Shandong Kerui Petroleum) and it is estimated that it would generate around 5,000 immediate jobs for its construction.

Final Considerations

Based on the analysis of the most important Brazilian experience attempting to increasing the production capacity of oil derivatives, the article showed recent challenges and characteristics of urban and regional development in the eastern portion of the Metropolitan Region of Rio de Janeiro. Explaining COMPERJ as a "driving industry" proposal for the development of the region, the study highlights the phases of boom, burst, and doom faced by Itaboraí and its immediate region since the beginning of the construction of the project.

The study indicates that regional development has Janus faced characteristics, in the sense that the conditions of stagnation experienced by the region for more than five decades would be very unlikely overcome without a broader investment effort; however, to date COMPERJ has presented itself more as a reinforcer of the region's historical challenges and liabilities, given the few initial objectives achieved amid the national and state economic crisis and the end of the international commodity boom.

Finally, the COMPERJ experience evidences the need for further reflection on development paths in peripheral regions, especially in relation to natural resource-based industrialization and megaprojects as inducers of socioeconomic development. A greater connection between national productive development objectives and a real strategy of well-being, inclusive urbanization, and industrialization backed by national social interests would be a more desirable alternative.

References

- ALTOMONTE, H. et al. Natural Resources in the Union of South American Nations (UNASUR). Situation and trends for a regional development agenda. Cepal / Unasur. Santiago, Chile, 2013.

- ARAÚJO, J. L. Petroleum industry and economy of Rio de Janeiro. In: AMERICA FREIRE, A.; SARMENTO, C. E.; MOTTA, M. S. (orgs.). A State in Question: the 25 years of Rio de Janeiro. Rio de Janeiro: FGV, 2001. p.249-282.

-

ARBOLEDA, M. Spaces of Extraction, Metropolitan Explosions: Planetary Urbanization and the Commodity Boom in Latin America. In: International Journal of Urban and Regional Research, 2015. Available: http://onlinelibrary.wiley.com/doi/10.1111/1468-2427.12290/abstract

» http://onlinelibrary.wiley.com/doi/10.1111/1468-2427.12290/abstract - AUTY, R.M. Resource-based Industrialization: Sowing the Oil in Eight Developing Countries. Clarendon Press, Oxford, UK, 1990.

- BACHA, E.; FISHLOW, A. The Recent Commodity Price Boom and Latin American Growth: More than new Bottles for Old Wine? In: OCAMPO, A.; Ros, J. The Oxford Handbook of Latin American Economics. Oxford University Press, New York, NY, 2011.

- BADIA-MIRÓ, M.; PINILLA, V.; WILLEBALD, H. (ed.) Natural Resources and Economic Growth. London, New York: Routledge, 2015.

- BAER, W. The Brazilian Economy. São Paulo: Nobel, 2012,

- BIELSCHOWSKY, R. (Org.) Fifty Years of Thinking at ECLAC. Editora Record. Rio de Janeiro, RJ, 2000.

- BOIANOVSKY, M. Commodities, natural resources and growth: a study through the history of economics. In: YING, Ma; TRAUTWEIN, H-M. Thoughts on Economic Development in China. London and New York, Routledge, 2013, p. 56-87.

- BRANDÃO, C. The Absences and Misses of Regional Analyzes in Brazil and the Proposal of a Long-Term Research Agenda, 2016. (Final Research Report IPEA, mimeo).

- BRANDÃO, C. A.; SIQUEIRA, H. (orgs.). Federative Pact, national integration and regional development. São Paulo: Perseu Abramo Foundation, 2013.

- BRITTO, J. Comperj: Reflections and Opportunities for the Municipalities of Conleste. Year V - Number 10. CIDE Foundation, Rio de Janeiro, RJ, 2011.

- BRUCKMANN, M. Natural Resources and Geopolitics of South American Integration. IN: VIANA, A. R.; BARROS, P. S.; CALIXTRE, A. B. Global governance and integration of South America. Brasília: IPEA, 2011.

- CANO, W. Regional Imbalances and Industrial Concentration in Brazil: 1930-70 and 1970-95. Campinas, SP: Institute of Economics - Unicamp, 1998. (30 Years of Economics, n° 2)

- CARNEIRO, R. Commodities, external shocks and growth: reflections on Latin America. Macroeconomics Series of Development. ECLAC, Santiago, 2012.

- ECLAC. Natural resources. Situation and trends for a regional development agenda in Latin America and the Caribbean. Santiago, Chile, Institutional Document of ECLAC, 2013.

- DAVIDOVICH, F. State of Rio de Janeiro: Uniqueness of a territorial context. Territory Magazine, Rio de Janeiro, RJ. No. 9, Jul-10, 2000. 10-24p.

- DICKEN, P. Global Shift: Mapping the Changing Contours of the World Economy. 6th Edition, The Guilford Press, New York, USA, 2012.

-

DINIZ, C. O risco da relitoralização. Interview granted to Carta Capital., 2012. Available at: https://www.cartacapital.com.br/economia/o-risco-da-relitoralizacao

» https://www.cartacapital.com.br/economia/o-risco-da-relitoralizacao - FARIA, W. Fifty Years of Urbanization in Brazil. New Studies CEBRAP, São Paulo, 3/1993.

- FARTHING, L.; FABER, N. Open Veins Revisited: Charting the Social, Economic, and Political Contours of the New Extractivism in Latin America. Latin American Perspectives Issue 222 September 2018 Volume 45 Number 5, 4-17.

- FIRJAN. Impacts of large investments in Rio de Janeiro and the challenges for the sustainable development of the State, 2009 (mimeo).

- FURTADO, C. Theory and policy of economic development. São Paulo: New Cultural, 1986.

- GORENSTEIN, S.; ORTIZ, R. Natural resources and primary sector-dependent territories in Latin America. Journal Area Development and Policy, 3: 1, 2018, 42-59.

- HIRSCHMAN, A. O. The Strategy of Economic Development. Yale University Press, 1958.

- IBGE - Brazilian Institute of Geography and Statistics. Regional Accounts of Brazil. Rio de Janeiro, RJ, 2017.

- JESUS, C. Labour in the Brazilian Shipbuilding Industry: a contribution to an analysis on the recovery period. In: VARELA, R.; MURPHY, H.; VAN DER LINDEN, M. (Org.). Shipbuilding and Ship Repair Workers around the Word. 1ed. Chicago, Amsterdam: Amsterdam University Press, Chicago Press, 2016, v. 1, p. 477-490.

- KLINK, J. Development Regimes, Scales and State Spatial Restructuring: Change and Continuity in the Production of Urban Space in Metropolitan Rio de Janeiro, Brazil. International Journal of Urban and Regional Research, Volume 37. 4 July 2013 1168-87.

- LANDER, E. El Neoextractivismo como modelo de desarrollo en América Latina y sus contradicciones. Heirinch Boll Stiftung, Berlin, 2014.

- LEDERMAN, D.; MALONEY, W. F. Natural Resources: Neither Curse nor Destiny. Washington, DC, Palo Alto, CA: World Bank; Stanford University Press, 2007.

- LÉFÈBVRE, H. A Revolução Urbana. Belo Horizonte: EDUFMG, 2004.

- MALTHUS, T. Princípios de Economia Política e Considerações sobre sua Aplicação Prática. Editora Abril Cultural São Paulo, SP. Coleção os Economistas, 1982.

- MATIAS, P.; SILVA, R. Baixada Fluminense - RJ: Notas sobre os Impactos Iniciais do Arco Metropolitano. Revista Continentes. PPGGEO-UFRRJ, ano 6, n.11, julho-dezembro, 2017.

-

MOYSÉS, Y. O Comperj: modelo de desenvolvimento hegemônico e contradições no espaço local (Itaboraí, Rio de Janeiro). Revista Geografar. Curitiba, v.5, n.1, p. 01-24, 2010. Disponível em: https://revistas.ufpr.br/geografar/article/view/17779

» https://revistas.ufpr.br/geografar/article/view/17779 - OCAMPO, J. A. La historia y los retos del desarrollo latinoamericano. CEPAL, ILPES: Santiago de Chile, diciembre de 2012.

-

PECK, J.; TICKELL, A. Neoliberalizing space. Antipode, 2002, 34 (3), 380-404. DOI: 10.1111/1467-8330.00247

» https://doi.org/10.1111/1467-8330.00247 - PÉREZ, C. Dinamismo tecnológico e inclusión social en América Latina: una estrategia de desarrollo productivo basada en los recursos naturales. Revista Cepal 100, abril 2010, 123-145.

- PERROUX, F. O Conceito de Pólo de Desenvolvimento. In SCHWARTZMAN, J. (org.). Economia Regional: textos escolhidos. Belo Horizonte: CEDEPLAR, 1977. (Primeira edição: Note sur la notion de póle de croissance, 1955).

-

PETROBRAS. Plano de Negócios da Empresa, 2008. Disponível em http://www.petrobras.gov.br/pt/

» http://www.petrobras.gov.br/pt/ - PINTO, E. C. A dinâmica dos Recursos Naturais no Mercosul na década de 2000: “efeito China”, estrutura produtiva, comércio e investimento estrangeiro. UFRJ, IE Texto para discussão 005, 2013.

- PIQUET, R. (org.). Mar de Riqueza, Terras de Contraste: o Petróleo no Brasil. Rio de Janeiro: Editora Mauad X, 2011.

- POSTALI, F. Petroleum royalties and regional development in Brazil: The economic growth of recipient towns. Resource Policy 34 (2009), 205-213.

- RAIS. Relação Anual de Informações Sociais/MTE. 2017.

- REDSUR. ¿Subiendo la Escalera? Oportunidades, obstáculos y lecciones en torno al escalamiento de las cadenas de recursos naturales de América del Sur. Montevideo: Red Sudamericana de Economia Aplicada, 2014.

- RICARDO, D. Princípios de Economia Política e Tributação. Coleção Os Economistas. São Paulo: Editora Abril Cultural, 1982.

-

RIMA COMPERJ. Petrobras - Concremat Engenharia [online]. Disponível em: http://www.petrobras.gov.br/pt/

, 2006.

» http://www.petrobras.gov.br/pt/ - ROSENSTEIN-RODAN, P. N. Notes on the Theory of the “Big Push. In: ELLIS, Howard S. Economic Development for Latin America. New York: St. Martin, 1961.

- ROSS, M.L. The Oil Curse: How Petroleum Wealth Shapes the Development of Nations. Princeton, NJ: Princeton Univ. Press, 2012.

- SERRA, J. Ciclos e Mudanças Estruturais na Economia Brasileira do após-Guerra. Revista de Economia Política, Vol. 2/2, número 6, abril-junho, 1982.

- SILVA, R. Royalties e desenvolvimento regional: uma reflexão sobre os desafios do Rio de janeiro. In: MONTEIRO NETO, A.; CASTRO, C.; BRANDÃO, C. (org.) Desenvolvimento Regional no Brasil - política, estratégias e perspectivas. IPEA, Brasília, DF, 2017.

- SILVA, R.; MATOS, M. Petróleo e Desenvolvimento regional: o Rio de Janeiro no pós-boom das commodities. Revista de Desenvolvimento Econômico - RDE - Ano XVIII - V. 2 - N. 34 - Agosto de 2016 - Salvador, BA - p. 704 - 722.

- SILVA, R. D. Recursos Naturais não Renováveis e Desenvolvimento Regional: Apontamentos para o Caso Brasileiro In: BRANDÃO, C. A. Território e Desenvolvimento: as múltiplas escalas entre o local e o global. Campinas: Editora da Unicamp, 2013.

- SILVA, R. Industry and Regional Development in Rio de Janeiro. Editor of Getúlio Vargas Foundation and Foundation of Research Support of the State of Rio de Janeiro, Rio de Janeiro, RJ, 2012.

- SINNOTT, E.; NASH, J.; DE LA TORRE, A. Natural resources in Latin America. Rio de Janeiro; Washington, DC: Elsevier World Bank, 2010.

- SKIDMORE, T. et al. Modern Latin America. Eighth Edition, Oxford Press, 2014.

- SMITH, A. An Inquiry Into the Nature and Causes of the Wealth of Nations. (Cannan ed.), Vol. 1 1982 [1776].

- STUDIO CLASS; IRAZÁBAL, C. Conleste: Regional Planning in Rio de Janeiro, Brazil. Urban Planning Studio, Columbia University: New York, Spring 2011. 122 pp.

-

SVAMPA, M. Consensus on Commodities and Valuation Languages in Latin America. New Society No 244, March-April 2013, https://www.nuso.org

» https://www.nuso.org - TORRES, R.; CAVALIERI, H.; HASENCLEVER, L. Petroleum and enclaves of the Fluminense Economic Development. Cadernos do Desenvolvimento, v. 8, n. 13. Rio de Janeiro: Celso Furtado Center, 2013.

- WILLIAMSON, J. G. Latin American Inequality: Colonial Origins, Commodity Booms, or Missed 20th Century Leveling? NBER Working Paper Series, January 2015.

-

1

Given its territorial size, Brazil would include the three models, with lower weight assigned to the temperate climate production, restricted to its Southern area.

-

2

Mayor Cardozo told El País in July 2015: "Schools and day care centers were built; new health centers were inaugurated. The hospital was improved and there were infrastructure works. How were we going to let the new arrivals without classrooms or the sick to die without medical attention?" http://brasil.elpais.com/brasil/2015/07/28/politica/1438102186_804949.html

- 3

Publication Dates

-

Publication in this collection

22 Aug 2019 -

Date of issue

May-Aug 2019

History

-

Received

31 Mar 2018 -

Accepted

13 Feb 2019

Boom, Burst, and Doom: The Petrochemical Complex of Rio de Janeiro as Catalyzer of Urban-Regional Development

Boom, Burst, and Doom: The Petrochemical Complex of Rio de Janeiro as Catalyzer of Urban-Regional Development

Source: Elaboration of author based on information from RIMA COMPERJ

Source: Elaboration of author based on information from RIMA COMPERJ

Source: Elaboration of the authors

Source: Elaboration of the authors

Source: UNDP (2016)

Source: UNDP (2016)

Source: Calculation and elaboration of author based on

Source: Calculation and elaboration of author based on